In a typical Amazon fashion, let’s start like every Amazon project: understand the customer and work backwards. So what do customers want? Jeff Bezos has some thoughts on this topic:

“I very frequently get the question: "What's going to change in the next 10 years?" And that is a very interesting question; it's a very common one. I almost never get the question: "What's not going to change in the next 10 years?" And I submit to you that that second question is actually the more important of the two - because you can build a business strategy around the things that are stable in time. ... [I]n our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, "Jeff, I love Amazon; I just wish the prices were a little higher." "I love Amazon; I just wish you'd deliver a little more slowly." Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

Customers want larger selection and lower prices and this is what we should expect with transition from a first party to a marketplace business.

Larger selection: by opening a platform to other sellers, platform selection increases. A marketplace distributes inventory sourcing to several sellers that can leverage their own network, access, agreements, and capital to source a much larger selection than even the best capitalized company would accomplish. Many sellers have exclusive agreements with vendors or manufacture their own products, so this strategy offers an additional competitive advantage: access to products that the competition does not carry.

Lower prices: opening a platform to other sellers increases supply, which in turn makes pricing more competitive. This shouldn’t be surprising to anyone who has attended an Economics 101 class. An increase in supply moves the supply curve on the right (from S to S1) and as a result the new market equilibrium is set at a lower price (P1 < P). This is especially true for commoditized products with high pricing transparency and low switching costs (think sellers on a marketplace selling the same item).

Impact of supply increase to price

As you might suspect, Amazon doesn’t leave things to chance. Amazon is complementing the invisible hand by creating a structure that amplifies the effect of this economic principle, enabling the competitive forces to take effect in every key aspect of the experience. Let’s see how this works for a typical customer journey.

The first step of a customer journey is search. Amazon has been very successful in competing with Google to become the top of mind product search engine. There are several surveys that point to the fact that Amazon has become a leader in product searches, with the gap between the two companies widening. This is very strategic for Amazon as search is the first opportunity to showcase a curated view of one's catalog and guide the customer to a purchasing decision. A second reason is the ability to build a very profitable ads business which I will cover in one of the next parts.

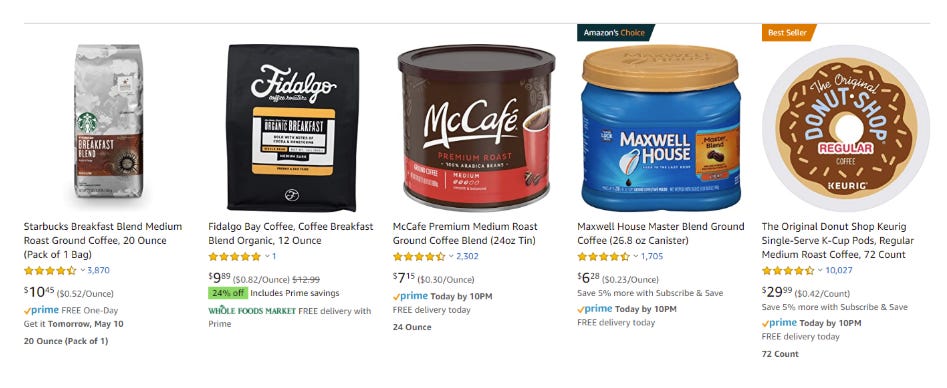

Searching for the term “coffee” on Amazon.com brings more than 10K results. These products (each one of which maps to several offers - I will get into the difference in a moment) compete for a purchase for a customer’s “coffee” search intent. Of course not all results are substitutes; you can find ground coffee, coffee pods, coffee machines, coffee mugs and several other products. However, Amazon knows that most customers typing the “coffee” query are looking for some kind of ground coffee or pods that’s why top results mostly include these types of products. Amazon also knows that customers don’t want to be overwhelmed and is providing guidance on the products customers should focus on. The Amazon search algorithm uses an elaborate ranking logic. Although Amazon doesn’t publicly share this logic, it is obvious that popular products with good customer reviews and competitive prices come up higher. As you can see, the first line of results includes products with many positive reviews (Fidalgo is an exception but we can attribute this to the fact that this product is carried by Whole Foods, an Amazon subsidiary). Amazon is signaling to sellers that the happier customers are with a purchase, the more visibility their product will get.

Image - Amazon Search

If you carefully observe this screenshot, you will also notice the Amazon Choice tag on the fourth product. Amazon informs customers that “Amazon's Choice recommends highly rated and well-priced products.” trying to influence customers and provide incentives for sellers to ensure customer satisfaction at competitive prices.

Assuming a customer decides that they actually want the Amazon Choice Maxwell House coffee, they click on the product and get directed to the product detail page. Amazon has taken a strategic decision to consolidate all seller listings for the same product (called offers) under a unified product page[1] . This results in an experience where customers can easily compare the same product offered by different sellers. Standardizing this experience, sellers compete on price, speed of delivery, and rating. Think how different this experience is compared to Ebay where every listing is displayed on a different page.

The below image shows the Amazon Detail Page for Maxwell House Coffee, with 13 new offers competing for a sale. In more suitable categories Amazon intensifies competition even further by also offering used options. Used books and electronics (now rebranded as Amazon renewed) have become another lever in Amazon’s mission to offer low prices.

Image - Amazon Detail Page

The large selection creates another effect known as the Paradox of choice, where having more choices doesn’t result in the best customer experience. Amazon solves this with the introduction of the BuyBox. The BuyBox is a one-click add to cart functionality (seen in the top black box) which recommends the “best” of the 13 competing offers and awards the BoyBox to this seller (interestingly in this case the seller is Amazon itself). This is important as based on price optimization software Feedvisor, more than 80% of Amazon sales go through the BuyBox. Customers have the option to browse other offers but in practice only a few of them do.

Once again Amazon balances larger selection with simplification of the buyer experience. While Amazon doesn’t share specific details on the algorithm, it shouldn’t be shocking that the main factors taken into account are price, fast free shipping, and great customer service. Amazon incentivizes sellers to provide an exceptional customer experience, making Amazon a better platform. Win, win, win.

Image - More offers

There are additional ways that Amazon intensifies competition within a detail page. If you look carefully at the previous image, in addition to the selected Master Blend option, Amazon also offers a one click switch to the Breakfast and House Blend options, each coming with their own detail page, buybox and additional offers. The same theme is applied in the several comparison and recommendation widgets like the “customer who viewed this item also viewed”.

Image - Customers who viewed this item also viewed

In many cases, products are not exactly the same but most customers consider them as substitutes. Amazon simplifies discovery and product comparisons, enabling customers to easily select the best value offer. For more technical products like laptops, this can include a summary of specs for customers to easily navigate the price/value tradeoff but identifying the features they value most.

Image - Product Comparison

------------------------------------------------------------------------------------------

Check out the other parts of this post: