This is the last piece of this series on marketplaces. I would love to get your feedback on the posts and any other ideas about topics of interest. If you enjoyed reading, feel free to share.

In the previous sections we offered an alternative playbook for developing a marketplace. This can be summarized as:

- Create a strong first party business to attract demand.

- Allow other sellers to compete for the same sale, side by side with your first party business.

- Keep high seller performance standards. Provide incentives for well performing sellers, while being strict with bad actors.

- Offer guarantees to ensure that your customers can trust the third parties.

- Launch platform tools and value added services to support sellers, focusing on areas with high variance.

- Leverage scale to spin the flywheel.

How does this translate to a broader playbook for ecommerce marketplaces?

Although it’s hard to predict the future, we can approach this through first principles. In the intro of this series we referred to a Jeff Bezos quote focusing on what is not going to change in the future:

“I very frequently get the question: "What's going to change in the next 10 years?" And that is a very interesting question; it's a very common one. I almost never get the question: "What's not going to change in the next 10 years?" And I submit to you that that second question is actually the more important of the two - because you can build a business strategy around the things that are stable in time. ... [I]n our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, "Jeff, I love Amazon; I just wish the prices were a little higher." "I love Amazon; I just wish you'd deliver a little more slowly." Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

Customers want great selection at competitive prices: Every ecommerce player should strive to carry more selection with a focus on what is relevant and desired by customers. While there are several ways to approach this goal, the Amazon experience so far gives us some good guidelines on how to go about it.

The third party model has proven to be successful and profitable, so Amazon has no reason to stop scaling the third party business. We can safely assume that the third party business will continue growing to reach an even larger portion than the 60% of total sales it holds today. This is a good proof for all other ecommerce businesses out there. First party businesses scale slower, so assuming the third party business continues to expand at the current rate, the portion of total sales composed by the first party business will be decreasing. Will this ever go to zero? The right question to ask is what kind of selection is a better fit for a first party model. Some products that will likely be primarily sourced through a first-party model are products third party sellers can’t source or can’t offer at a competitive price, products a first party business can sell more profitably, and products that are strategic to be sold by the first party. Examples include products from major brands that would prefer to only work with a large player vs. several Amazon resellers to better control the experience (e.g. fashion brands), strategic best selling products or commoditized products that have better economics as private labels (e.g. batteries, cables), and newly released products where a large player can acquire more supply and ensure no price gouging (e.g. PS5). The biggest question (which is worth a separate post) is how will large brands react to the emergence of marketplaces and will they be taking their own DTC (direct to consumer) route.

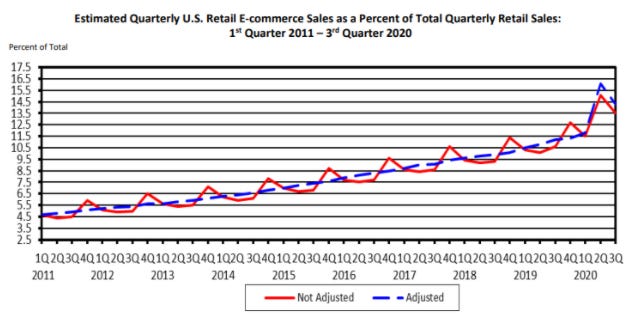

Another way of increasing selection is to expand into more categories. Even with the huge growth in the last ten years and the acceleration that was triggered by a pandemic, US ecommerce sales only accounted for 14.3% of total retail sales in Q3 2020. The growth is impressive, but still ~86% of total sales are taking place offline.

Online sales are not evenly distributed across product categories. Categories like books/music/video have online sales in the range of 62% while consumer electronics and toys are close to 50%. On the other side, there are categories where only a small fraction of total sales are currently taking place online. Health, personal care and beauty are at 13% while food and beverage at 3.7%. These are also some of the largest areas of opportunity which coincide with Amazon’s latest bets. In grocery, Amazon is already going through the first phase of their successful playbook to build supply, this time by acquiring an established player - Whole Foods - to speed up the market entry. Expect more companies and niche players to try to enter these less established and fast growing online markets.

Customers want fast delivery: Back in the day, receiving an order after several weeks was the norm, but these days are long gone. Amazon has been pushing the envelope on speed, starting with the Prime two day shipping, and recently moving to next day or even same day delivery, in addition to launching a superfast grocery delivery option which can fulfill an order in less than an hour.

Customers now expect speedy delivery and this becomes a competitive advantage. Amazon has developed a huge network that currently delivers about a third of US parcels, exceeding the UPS and FedEx volumes. Large players will continue to invest in new fulfilment centers to decrease the distance from their locations to their customers. Hybrid players will scale the use of their retail stores as pickup points and/or dark stores to support online orders. The trend with Amazon and Walmart is very clear.

Smaller players will be forced to compete on speed. Since setting up a network for fulfillment centers is a costly endeavor, new solutions will emerge. An interesting option in this space is Flexe, a Seattle based startup that offers warehousing as a service.

I am fairly confident about the above trends, but will also try some more interesting (and maybe controversial) predictions for the next years:

Free shipping will become the only shipping option: This has been tested thoroughly and results are conclusive. It shouldn't surprise anyone that customers love free shipping. I expect this trend to get even bigger with Retailers and marketplaces offering free shipping as a default. To make economics work they could try to incentivize subscription programs like Prime or shipping thresholds to increase basket sizes. Either way, the amount of orders where customers pay a shipping fee will be minimal.

Several more large players will launch subscription programs: we discussed how Amazon Prime is one of the main flywheel drivers that fuels the company's growth. This not only creates a moat in an otherwise relatively commoditized space, but also creates a repeated revenue stream that companies and investors love. In Q3 2020 Amazon recorded $6.5B in subscription revenue. In the US 82% of households are Prime members. As Scott Galloway puts it, “this is more than (ones that) voted in the 2016 election, have a pet, attend church, or decorate a Christmas tree”. Walmart followed the same strategy last year with the launch of Walmart+ which already counts 30MM paid members. I expect a few more large players to launch a similar subscription in the next few years.

Larger retailers will get into advertising as a side margin enhancing business: one more idea we covered in this series was Amazon’s ability to monetize through their inhouse ads business, with 2020 revenue reaching an impressive $12.7Bn, growing 23% YoY. While this business requires some scale, the opportunity is so big and the margin so compelling, that several more players will follow this trend. I am expecting this to be a major focus for any player with the scale to support it.

The only viable way to enter retail will be a niche: this is more of a fact and less of a prediction. The only way to compete today as a new entry is either through a small product portfolio and a huge branding investment (e.g. Allbirds, Blueland, Casper) or though entering a specific category (e.g. Chewy.com, Wayfair). Some of these players can evolve in decades to an everything store, but starting as such is a recipe for failure in mature markets.

Social shopping will still not make a breakthrough in the next few years: I don’t expect the idea of social shopping to pick up anytime soon. To be clear, social networks will develop additional ecommerce capabilities (e.g. Facebook shops) and build seamless integrations with ecommerce providers (e.g. Tik Tok and Shopify partnership) but I consider these as ecommerce plays with a pinch of advertising, rather than a full scale social commerce vision.

Would love to hear your thoughts and feedback.

-----------------------------------------------------------------------------------------------------

Read the next parts and subscribe to get new posts in your inbox: