Another approach to the chicken and egg problem - Part 2

Why does Amazon love the marketplace model?

Larger selection and lower prices are good reasons for customers to like marketplaces. But why does the decision to allow other sellers to list their products on the Amazon website make sense for Amazon? Amazon slowly transitioned from a seller to a platform, enjoying several benefits that spin the marketplace flywheel. Better selection improves the customer experience, which attracts more customers. A marketplace with more customers naturally also attracts more sellers. This cycle grows the marketplace, which in turn leads to a lower cost structure through economies of scale and even lower prices as Amazon is passing the savings to customers.

Amazon flywheel

Source: Amazon

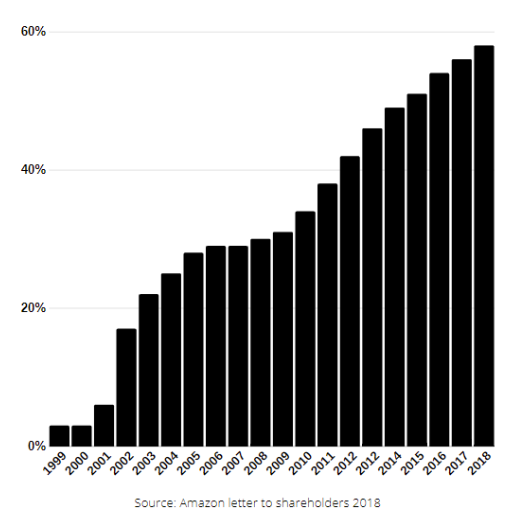

The flywheel effect drives a huge topline and bottomline growth. Based on Jeff Bezos’s 2018 letter to Amazon shareholders, “Third-party sellers are kicking our first party butt. Badly.”, reaching a 58% of total physical Gross Merchandise Sales (GMS) on Amazon. This was not an easy feat. “And it’s a high bar too because our first-party business has grown dramatically over that period, from $1.6 billion in 1999 to $117 billion this past year. The compound annual growth rate for our first-party business in that time period is 25%. But in that same time, third-party sales have grown from $0.1 billion to $160 billion – a compound annual growth rate of 52%.”

Physical third party sales as a percent of total Amazon sales

Why did the third party business grow faster than the first party? There are several reasons but this was definitely not a coincidence, meaning Amazon played a critical role into this outcome. One reason that explains the different growth trajectories between first and third party models is the cost scaling.

Every business has a fixed and a variable cost component. Fixed cost doesn’t change with a sales increase, while variable cost increases as the business grows. When comparing a first and a third party ecommerce business the fixed cost is similar, mostly consisting of technology investments: developing a website with features like payments processing, security, and search, setting up a hosting infrastructure, investing in search engine optimization and performance marketing, and so on.

Diving deeper into variable costs, helps us better understand the difference in economics. A first party business needs to invest in direct relationships with brands and distributors. This means employing vendor managers and instock managers that manage each product category. In addition, they need to set up a capital intensive fulfillment network which usually consists of several warehouses (and the non negligible supply chain technology investment), while spending even more on purchasing inventory. These variable costs are much lower for third party businesses, as most outsource them to sellers.

Interestingly, instead of outsourcing these functions to sellers, Amazon took the path to develop a cutting edge fulfillment network for their first party business and also make it available to sellers. Amazon needs to be close to customers to meet the two day (now becoming next day) delivery promise. To support a country like the US, this means building tens or even hundreds of warehouses (Amazon calls them Fulfilment Centers - FCs). We will cover the Amazon fulfillment network in one of the later sections, but it’s worth noting that one of the primary marketplace benefits was that it gave Amazon incremental sales volumes to reach economies of scale at a faster pace.

Amazon managed to turn a first party business with notoriously thin margins to a profitable platform, while generating incremental revenue from services like Fulfillment by Amazon (FBA), a program that provides inventory storage, packaging, and shipping services to Amazon sellers. More recently, Amazon launched an even more profitable advertising business on top of their e-commerce business that generated $4.8B in Q4 2019.

By some estimates, Amazon’s third party operating margins are in the 15-20% range (including specific services like FBA) compared to single digit margins for first-party sales. If you add the better scaling and the fact that the marketplace business doesn’t require carrying any inventory (so no inventory risk) things get even better.

Notably Amazon didn’t shut down their Retail business, but created a hybrid model operating a marketplace and being the largest seller in this marketplace at the same time. This poses another interesting question that we will answer in a later part - why didn’t Amazon fully convert their business to a pure marketplace play?

------------------------------------------------------------------------------------------

Read the next parts and subscribe to get new posts in your inbox: